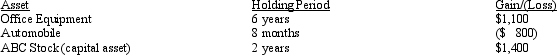

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $22,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

Anxiety

A mental health disorder characterized by feelings of worry, anxiety, or fear that are strong enough to interfere with one's daily activities.

Chemical Imbalance

A theory suggesting that mental health conditions are associated with changes in the brain's chemical systems.

Excessive Anxiety

A state of heightened worry, nervousness, or unease that is disproportionate to the actual likelihood or impact of the feared event or situation.

Method

A systematic way of doing something, especially in scientific research or problem-solving.

Q25: Depreciable personal property was sold at a

Q39: Ten years ago,Oro Corporation purchased all of

Q54: Karla owns 200 acres of farm land

Q71: In January 2012,Tammy acquired an office building

Q71: A security that is a capital asset

Q75: Which tax-related website probably gives the best

Q80: Jordan and his two brothers are equal

Q97: Currently all C corporations must file a

Q104: On January 1,2009,Gail (an executive)receives a warrant

Q130: What is the difference between the depreciation