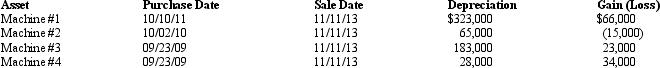

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

Breast Feeding

A natural process of feeding babies with milk directly from the mother's breasts, promoting health benefits for both mother and child.

Accidents

Accidents are unexpected events that result in injury or damage, often occurring because of a lack of caution or unforeseen circumstances.

Cause of Death

The specific injury, disease, or failure of a vital bodily function resulting in an individual's death.

Young Children

Individuals in the early stages of childhood, typically considered to be between the ages of 2 and 6 years old.

Q13: A franchisor licenses its mode of business

Q20: Discuss the treatment of realized gains from

Q21: In 2012,George used the FIFO lower of

Q53: Gains and losses on nontaxable exchanges are

Q53: The use of the LIFO inventory method

Q60: Gray is a calendar year taxpayer.In early

Q64: George and Jill are husband and wife,ages

Q68: Lucinda,a calendar year taxpayer,owned a rental property

Q93: An eligible taxpayer may elect to receive

Q96: In determining which organizational expenditures can be