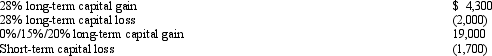

Theresa and Oliver,married filing jointly,and both over 65 years of age,have no dependents.Their 2012 income tax facts are:

What is their taxable income for 2012?

What is their taxable income for 2012?

Definitions:

Unit Product Cost

The total cost to produce a single unit of product, including direct materials, direct labor, and manufacturing overhead.

Absorption Costing

A method of accounting where all manufacturing costs (direct materials, direct labor, and manufacturing overhead) are included in the product cost, making the product more expensive to produce.

Gross Margin

Gross margin is the difference between revenue and the cost of goods sold divided by revenue, expressed as a percentage, indicating the efficiency of turning sales into profit.

Net Operating Income

The total profit of a company after operating expenses are subtracted from total revenue but before taxes and interest are deducted.

Q13: A barn held more than one year

Q18: Which of the following taxpayers is required

Q31: Over the past 20 years,Alfred has purchased

Q33: Brown Corporation had consistently reported its income

Q36: Robin Corporation has ordinary income from operations

Q61: In computing the foreign tax credit,the greater

Q63: The accrual method generally is required to

Q94: The company has consistently used the LIFO

Q105: As of January 1,2012,Amanda,the sole shareholder of

Q133: In determining the basis of like-kind property