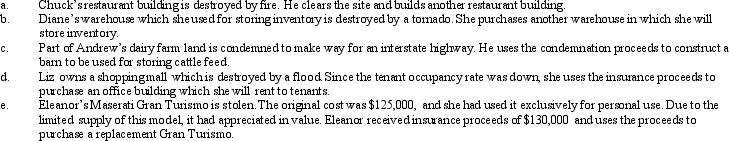

For each of the following involuntary conversions,determine if the property qualifies as replacement property.

Definitions:

Dividend Income

Income received from owning shares in a company, typically paid out from the company's earnings to its shareholders at set intervals.

Other Comprehensive Income

Revenues, expenses, gains, and losses that are not included in net income but affect a company's equity, including items like foreign currency items and unrealized gains on securities.

Statement Of Income

A financial report that shows a company's revenues, expenses, and profits over a specific period, typically a quarter or year, also known as an income statement.

Unrealized Gains

Increases in the value of assets that a company holds which have not yet been sold and thus not "realized."

Q3: Section 1245 may apply to depreciable farm

Q38: Color,Inc.,is an accrual basis taxpayer.In December 2013,the

Q63: Under what circumstance is there recognition of

Q73: A retailer must actually receive a claim

Q84: The $1 million limitation for deductible executive

Q89: Employers are encouraged by the work opportunity

Q95: During 2012,Barry (who is single and has

Q102: In addition to other gifts,Megan made a

Q112: For the ACE adjustment,discuss the relationship between

Q123: Lynn transfers her personal use automobile to