Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Coping Mechanisms

Strategies or behaviors individuals use to manage stress, emotional conflict, or internal and external demands that are perceived as difficult.

Long-Term Care

Services and support provided to individuals with chronic illnesses or disabilities, focusing on their medical, personal, and social needs over an extended period.

Homeostatic Mechanism

The processes and systems within organisms that regulate internal conditions (like temperature, pH, and glucose levels) to maintain a stable, constant environment.

Blood Pressure

The force exerted by circulating blood upon the walls of blood vessels, a critical indicator of cardiovascular health.

Q14: In 2012,Emily invests $100,000 in a limited

Q16: What kinds of property do not qualify

Q17: Since most tax preferences are merely timing

Q23: Certain situations exist where the wage-bracket table

Q49: Which,if any,of the following correctly describes the

Q67: The AMT does not apply to qualifying

Q83: Seth had interest income of $31,000,investment expenses

Q102: How can interest on a private activity

Q133: If a taxpayer purchases taxable bonds at

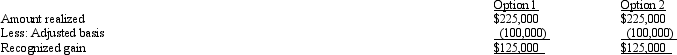

Q147: Molanda sells a parcel of land for