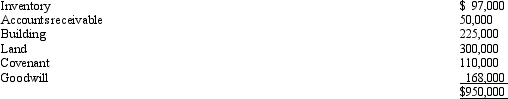

Hubert purchases Fran's jewelry store for $950,000.The identifiable assets of the business are as follows:

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Definitions:

Q4: Samuel,head of household with two dependents,has 2012

Q23: Melvin receives stock as a gift from

Q36: Katie sells her personal use automobile for

Q37: The exercise of an incentive stock option

Q38: The amount of the deduction for medical

Q45: The amount received for a utility easement

Q55: Individuals who are not professional real estate

Q57: Summer Corporation's business is international in scope

Q63: Lease cancellation payments received by a lessor

Q133: If a taxpayer purchases taxable bonds at