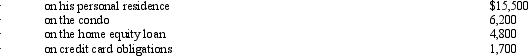

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2012,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2012,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2012?

What amount,if any,must Ted recognize as an AMT adjustment in 2012?

Definitions:

Note Balance

The remaining amount owed on a promissory note after payments have been made.

Refinancing

Replacing an old loan with a new loan, typically with better terms, such as a lower interest rate.

Loss Contingency

A potential financial loss to a company that might occur in the future due to past events or transactions, depending on the outcome of uncertain future events.

Range

The difference between the highest and lowest values in a set of numbers, indicating the spread or dispersion.

Q1: Qualified research and experimentation expenditures are not

Q1: The deduction for personal and dependency exemptions

Q22: The value added tax (VAT)has had wide

Q22: Cardinal Corporation hires two persons certified to

Q48: Consider the following three statements: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4131/.jpg"

Q59: Discuss the relationship between the postponement of

Q60: Ed and Cheryl have been married for

Q63: Congress reacts to judicial decisions that interpret

Q73: A small employer incurs $1,600 for consulting

Q95: The formula for the Federal income tax