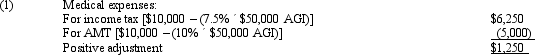

Luke's itemized deductions in calculating taxable income are as follows:

Definitions:

Net Advantage

The total benefits minus the total costs of an investment or decision, used to determine its overall value or utility.

MACRS Depreciation

A method of depreciation used for tax purposes in the United States, allowing businesses to recover the cost of an asset over a specified life span through annual deductions.

Incremental Cash Flow

The additional operating cash flow that an organization receives from taking on a new project.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on income or profits.

Q8: Virginia had AGI of $100,000 in 2012.She

Q37: The exercise of an incentive stock option

Q39: Match the treatment for the following types

Q54: If property that has been converted from

Q58: In the current year,Kelly had a $35,000

Q68: Dena owns interests in five businesses and

Q97: During 2012,Ralph made the following contributions to

Q106: Roger is employed as an actuary.For calendar

Q116: On February 2,2012,Karin purchases real estate for

Q119: Several years ago,Lucas purchased extra grazing land