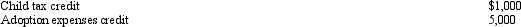

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Transfer Price

The price charged between related entities within the same corporation for goods and services exchanged.

Outside Supplier

A third-party entity that provides goods or services to a company, which are not produced in-house.

Contribution Margin

The amount by which sales revenue exceeds variable costs of production, indicating how much revenue contributes to fixed costs and profits.

Motor Division

A specialized department or subsidiary within a company focused on the development and manufacturing of engines or motor vehicles.

Q7: Harry,the sole income beneficiary,received a $40,000 distribution

Q9: The deduction for charitable contributions in calculating

Q32: David participates 580 hours in an activity

Q62: Which of the following statements regarding the

Q70: Last year,Wanda gave her daughter a passive

Q73: Which of the following normally produces positive

Q88: Noelle owns an automobile which she uses

Q96: Ben sells stock (adjusted basis of $25,000)to

Q99: Paula inherits a home on July 1,2012,that

Q101: Which,if any,of the following transactions will decrease