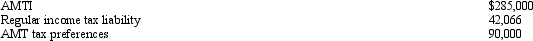

Caroline and Clint are married,have no dependents,and file a joint return in 2012.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Intellectual Disability

A disability characterized by significant limitations in both intellectual functioning and in adaptive behavior, which covers a range of everyday social and practical skills.

Flynn Effect

The observed substantial and long-term increase in both fluid and crystallized intelligence test scores measured in many parts of the world over the 20th century.

Savant Syndrome

A condition in which a person with significant mental disabilities demonstrates certain abilities far in excess of average.

Flynn Effect

The Flynn Effect describes the observed rise over time in standardized intelligence test scores, suggesting that average IQ scores increase from one generation to the next.

Q38: A provision in the law that compels

Q43: The Zhong Trust is a calendar-year taxpayer.Its

Q66: Is it possible that no AMT adjustment

Q81: A taxpayer whose principal residence is destroyed

Q89: Harry,the sole income beneficiary,received a $40,000 distribution

Q90: Ned,a college professor,owns a separate business (not

Q92: The bank forecloses on Lisa's apartment complex.The

Q95: During 2012,Barry (who is single and has

Q127: Morgan inherits her father's personal residence including

Q143: What is the general formula for calculating