Timothy suffers from heart problems and,upon the recommendation of a physician,has an elevator installed in his personal residence.In connection with the elevator,Timothy incurs and pays the following amounts during the current year:

The system has an estimated useful life of 20 years.The appraisal was to determine the value of Timothy's residence with and without the system.The appraisal states that the system increased the value of Timothy's residence by $2,000.How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation)in the current year?

The system has an estimated useful life of 20 years.The appraisal was to determine the value of Timothy's residence with and without the system.The appraisal states that the system increased the value of Timothy's residence by $2,000.How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation)in the current year?

Definitions:

Ingroup

A group to which an individual belongs and identifies with, often leading to favoritism towards member and bias against outgroup members.

Brain Scans

Medical imaging techniques used to view the structure or function of the brain, including MRI and CT scans, to diagnose or study neurological conditions.

Nonconformists

Individuals who reject or do not follow prevailing social norms or practices.

Amygdala

A part of the brain involved in experiencing emotions, especially fear and pleasure.

Q29: Which,if any,of the following items is subject

Q43: The maximum child tax credit under current

Q52: Qualifying tuition expenses paid from the proceeds

Q61: Entity accounting income is controlled by the

Q63: Identify the types of income that are

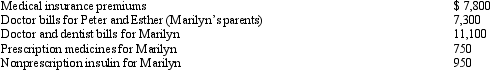

Q86: During 2012,Hugh,a self-employed individual,paid the following amounts:

Q89: Kay,who is single,had taxable income of $0

Q91: The civil fraud penalty can entail large

Q117: In which of the following situations is

Q123: Beneficiary information concerning a trust's income and