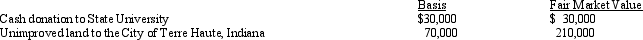

Paul,a calendar year married taxpayer,files a joint return for 2012.Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

Definitions:

Psychiatric Hospital

A specialized medical facility dedicated to the diagnosis, treatment, and care of individuals with mental illnesses.

Dialectical Behavior Therapy

A form of psychotherapy that combines behavioral techniques with concepts of mindfulness and acceptance, primarily used for treating borderline personality disorder.

Acceptance-based Procedures

Therapeutic techniques that emphasize acknowledging and accepting thoughts and feelings rather than fighting or changing them.

Evidence-based Treatment

A treatment protocol that is supported by systematic research demonstrating its effectiveness.

Q13: Sam and Betty are married,have four dependent

Q24: Leona borrows $100,000 from First National Bank

Q30: Which of the following correctly describes the

Q36: State income tax refund received after death

Q55: Identify from the list below the type

Q70: Why is it generally undesirable to pass

Q77: When qualified residence interest exceeds qualified housing

Q99: On October 2,2012,Ross quits his job with

Q101: Like a corporation,the fiduciary reports and pays

Q160: The Malik Estate operates a manufacturing business.Malik