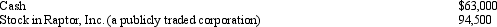

Marilyn is employed as an architect.For calendar year 2012,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Innate Tendency

An natural or instinctual inclination or propensity in living organisms towards certain behaviors, reactions or developments.

Goslings

Young geese that have not yet reached maturity.

Ambivalent Attachment Pattern

A type of attachment characterized by feelings of uncertainty or anxiety about a relationship, often resulting in mixed feelings toward the attachment figure.

Q51: Transfers to political organizations are exempt from

Q59: Certain adjustments apply in calculating the corporate

Q70: Last year,Wanda gave her daughter a passive

Q71: Moore incurred circulation expenditures of $300,000 in

Q86: Jed spends 32 hours a week,50 weeks

Q87: Marge purchases the Kentwood Krackers,a AAA level

Q95: Future interest

Q114: Misty owns stock in Violet,Inc.,for which her

Q129: The Federal income tax is based on

Q135: Faith inherits an undivided interest in a