George is single,has AGI of $255,300,and incurs the following expenditures in 2012.

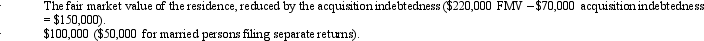

What is the amount of itemized deductions George may claim?

What is the amount of itemized deductions George may claim?

Definitions:

Employee-Friendly

Corporate policies or practices designed to provide a supportive and accommodating work environment for employees.

Overtime

Additional time worked by an employee beyond their regular working hours, typically compensated at a higher pay rate.

Environmental Regulations

Laws and policies aimed at protecting the environment by setting standards and guidelines for pollution control, resource management, and ecosystem preservation.

Legal

Pertains to matters related to the law, including regulations, rights, and obligations that govern individuals and entities.

Q3: Jason's business warehouse is destroyed by fire.As

Q11: The tax credit for rehabilitation expenditures for

Q32: The Suarez Trust generated distributable net income

Q46: C corporations are subject to a positive

Q65: During the year,Victor spent $300 on bingo

Q73: Trusts can select any Federal income tax

Q76: Mitchell owned an SUV that he had

Q85: Linda owns investments that produce portfolio income

Q96: No state has offered an income tax

Q120: On the date of her death,Ava owned