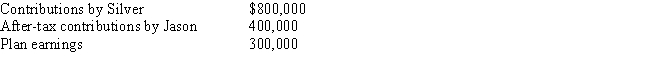

At the time of his death,Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance.The balance of the survivorship feature in his pension plan is:

The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

Definitions:

Defective Corporation

A corporation whose incorporation process included an error or omission.

Corporate Status

A legal status that allows a company to operate as its own legal entity, separate from its owners.

Charitable Donations

Voluntary contributions made to nonprofit organizations or causes without expectation of receiving something in return.

Closely Held Corporations

Corporations that have a small group of shareholders with no market for buying or selling company stock. They often involve family businesses.

Q13: Judy paid $40 for Girl Scout cookies

Q37: A deemed paid foreign tax credit is

Q56: Income beneficiary Molly wants to receive all

Q75: Harry and Sally were divorced three years

Q94: The tax professional can reduce the chances

Q120: On the date of her death,Ava owned

Q149: Jokerz,a CFC of a U.S.parent,generated $80,000 Subpart

Q154: Cole purchases land for $500,000 and transfers

Q163: An advance pricing agreement (APA) is used

Q191: Typically,sales/use taxes constitute about 20 percent of