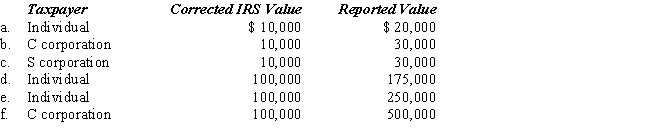

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal Federal income tax rate of 35%.

Definitions:

Expatriate Staffing Programs

Initiatives by organizations to staff their overseas operations with employees who are temporarily living outside their native country.

Integrated Selection-Orientation-Repatriation

A comprehensive approach in international human resources management that covers the process of selecting expatriates, preparing them for assignments (orientation), and reintegrating them into their home country's operations after their assignment is over (repatriation).

Sink-Or-Swim

A situation in which one must either succeed without help or support or fail completely.

Highly Situational Language

Refers to the use of language that is highly dependent on the specific context or situation in which it is used.

Q10: The tax consequences to a donor of

Q43: Rachel owns an insurance policy on the

Q59: Watch,Inc.,a § 501(c)(3) exempt organization,solicits contributions through

Q60: WorldCo,a foreign corporation not engaged in a

Q64: The grantor of a trust generally designates

Q72: Exclusion amount

Q75: In terms of revenue neutrality,comment on a

Q78: Hendricks Corporation,a domestic corporation,owns 40 percent of

Q119: A synonym for executor.

Q162: Typically included in the sales/use tax base