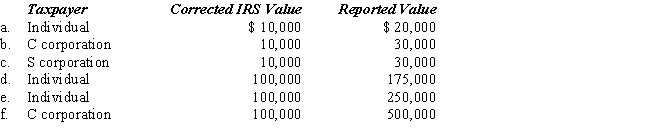

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal Federal income tax rate of 35%.

Definitions:

Thailand

A country in Southeast Asia known for its tropical beaches, opulent royal palaces, ancient ruins, and ornate temples displaying figures of Buddha.

Taiwan

An island in East Asia, known for its vibrant democracy, advanced technology industry, and rich cultural heritage.

Low Self-Esteem

The feeling of having little self-worth or value, often reflecting a negative self-assessment or view of oneself.

High Rates

In various contexts, high rates can refer to the increased frequency or occurrence of a specific event or characteristic.

Q3: Prescription drugs and medicines purchased by a

Q40: A(n) _ must obtain a Preparer Tax

Q41: Owner of shares counted in determining whether

Q64: In community property states,not all property acquired

Q81: A penalty can be assessed from an

Q84: If a state follows Federal income tax

Q91: A service engineer spends 80% of her

Q133: Clarence pays the medical providers (e.g.,physicians,hospital) for

Q171: In the broadest application of the unitary

Q179: Hill Corporation is subject to tax only