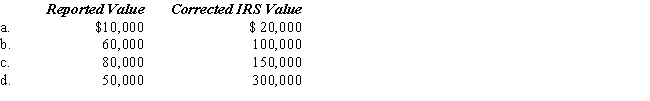

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal Federal estate tax rate of 40%.

Definitions:

Comprehend

To grasp mentally; understand.

Down Syndrome

A condition caused by an extra chromosome on the 21st pair and characterized by mental deficiency, a broad face, and slanting eyes.

Extra Chromosome

An atypical condition where an individual has more than the usual number of chromosomes, leading to genetic disorders such as Down syndrome.

Chromosomes

Structures located within the cell nucleus, composed of tightly coiled DNA and proteins, that carry genetic information crucial for inheritance, cell division, and individual development.

Q21: Federal general business credit.

Q23: Howard establishes a trust,life estate to his

Q46: Homer purchases a U.S.savings bond listing title

Q49: A fiduciary assigns its tax credits to

Q84: Under a prenuptial agreement,Herbert transfers stock to

Q92: José Corporation realized $900,000 taxable income from

Q135: Maria did not pay her Federal income

Q143: Generally,accrued foreign income taxes are translated at

Q160: Goolsbee,Inc.,a U.S.corporation,generates U.S.-source and foreign-source gross income.Goolsbee's

Q183: Kim Corporation,a calendar year taxpayer,has manufacturing facilities