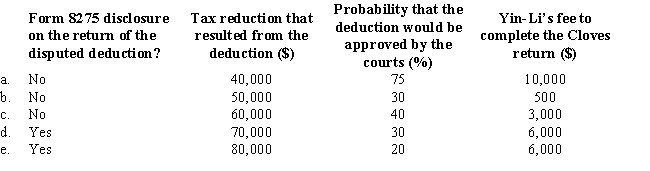

Yin-Li is the preparer of the Form 1120 for Cloves Corporation.On the return,Cloves claimed a deduction that the IRS later disallowed on audit.Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Development Hurdle

Challenges or obstacles that must be overcome during the process of developing a new product, service, or project.

Mimicry

The action or art of imitating someone or something, often used as a survival strategy in the natural world.

Outcome-based

Pertains to approaches or methods that focus primarily on achieving specific results or outcomes, often used in management, education, and healthcare settings.

Knowledge-based

Refers to processes, practices, or systems that rely primarily on the use of specialized knowledge or expertise.

Q15: In computing the property factor,property owned by

Q16: Foreign taxpayers earning income inside the United

Q24: Ramirez Corporation is subject to income tax

Q73: In international corporate income taxation,what are the

Q75: Your client Pryce is one of the

Q93: An appropriate transfer price is one that

Q94: A Qualified Business Unit of a U.S.corporation

Q98: In most states,legal and accounting services are

Q113: Which of the following statements is true,regarding

Q175: Deduction for advertising expenditures.