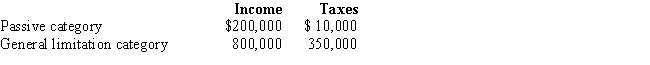

Britta,Inc.,a U.S.corporation,reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Critical Thinking

Engaging in a detailed investigation and judgment of a situation to form an assessment.

Social Psychologist

A professional who studies how individuals think, influence, and relate to one another within the context of society and social interactions.

Negative Perceptions

The inclination to view situations, people, or objects in a pessimistic or detrimental light.

Persistent Human Traits

Long-lasting characteristics or behaviors that are consistent over time and across situations in individuals.

Q6: Troy,an S corporation,is subject to tax only

Q6: Chung's AGI last year was $180,000.Her Federal

Q40: Certain § 501(c)(3) exempt organizations are permitted

Q66: Matt and Patricia are husband and wife

Q73: When a tax issue is taken to

Q84: Maroon,Inc.,a tax-exempt organization,leases a building and equipment

Q96: Vera is audited by the IRS for

Q110: Given the following information,determine if FanCo,a foreign

Q120: Theater,Inc.,an exempt organization,owns a printing company,Printers,Inc.,which remits

Q136: Failure to sign the return.