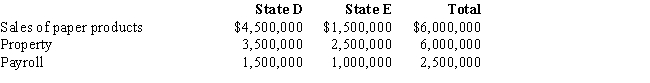

Milt Corporation owns and operates two facilities that manufacture paper products.One of the facilities is located in State D,and the other is located in State E.Milt generated $1,200,000 of taxable income,comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in E.E does not distinguish between business and nonbusiness property.D apportions business income.Milt's activities within the two states are outlined below.

Both D and E utilize a three-factor apportionment formula,under which sales,property,and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Definitions:

Degree of Total Leverage

A financial ratio that measures the sensitivity of a company's earnings per share to fluctuations in its operating income, considering both operating and financial leverage.

Financial Risk

The possibility of losing money on an investment or business venture, including various types of risks like market risk, credit risk, and operational risk.

Business Risk

The exposure a company or investor faces due to uncertainties in the operating environment, impacting its profitability.

Contribution Margin

The selling price per unit, minus the variable cost per unit, indicating the contribution towards covering fixed costs and profit.

Q4: Recently,the overall Federal income tax audit rate

Q8: The starting point in computing state taxable

Q31: The tax professional can do more than

Q121: Which of the following excise taxes are

Q124: Cheng filed an amended return this year,claiming

Q130: Aiding in preparing an improper tax return.

Q137: Circular 230 requires that the tax practitioner

Q144: Performance,Inc.,a U.S.corporation,owns 100% of Krumb,Ltd.,a foreign corporation.Krumb

Q155: All of the U.S.states use an apportionment

Q164: Compute the failure to pay and failure