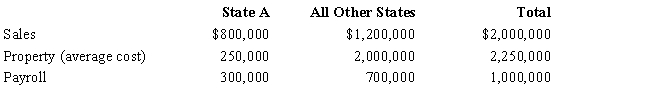

You are completing the State A income tax return for Quaint Company,LLC.Quaint operates in various states,showing the following results.

In A,all interest is treated as apportionable income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

Definitions:

Empathy

The ability to understand and share the feelings of another person, essentially placing oneself in another's position emotionally.

Egalitarian

Pertaining to the belief that every individual is equal and should have the same rights and chances.

Sensitivity

The quality or condition of being easily affected by external stimuli or being aware of and able to intuitively feel subtle changes or emotions.

Gender Awareness

Recognizing and understanding the social, cultural, and psychological aspects of gender and gender differences, including one's own gender identity.

Q56: Undervaluation of a reported item.

Q70: Rule that requires determination of the dividend

Q96: What are the excise taxes imposed on

Q99: Tax-exempt income is not separately stated on

Q111: In connection with the taxpayer penalty for

Q112: Which of the following is not immune

Q122: An individual might be incarcerated upon a

Q125: Georgio,a calendar year taxpayer subject to a

Q126: Stephanie is a calendar year cash basis

Q140: Which statement is incorrect as to the