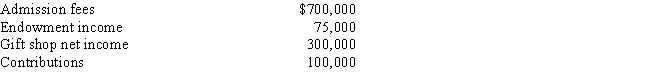

First Americans,Inc.,a § 501(c)(3) organization,operates a museum which depicts the lives of a tribe of Native Americans.It charges an admission fee,but also finances its operations through endowment income,contributions,and gift shop sales.The gift shop is operated by 50 volunteers and the museum is operated by 15 employees.Revenue by source is:

a.Determine the amount of First Americans' unrelated business income (UBI).

b.Determine the amount of First American's unrelated business income tax (UBIT).

Definitions:

Necessary Buffer

A strategic reserve or margin of safety to mitigate risk or unforeseen circumstances, ensuring stability and continuity.

Inventory

The items or goods a business holds for the purpose of sale or production, including raw materials, work-in-progress, and finished goods.

Setup

An overhead activity that consists of changing tooling in machines in preparation for making a new product.

Preparing Operation

The process of getting equipment, systems, or procedures ready for use or execution in a business context.

Q21: Federal general business credit.

Q24: One similarity between the tax treatment accorded

Q26: For sales/use tax purposes,nexus usually requires that:<br>A)The

Q42: Kunst,a U.S.corporation,generates $100,000 of foreign-source income in

Q44: Compute Still Corporation's State Q taxable income

Q45: Your client,Hamlin Industries,wants to reduce its overall

Q63: Target shareholders recognize gain or loss when

Q67: Fern,Inc.,Ivy,Inc.,and Jeremy formed a general partnership.Fern owns

Q81: The transfer of the assets of a

Q139: A meal eaten at a restaurant while