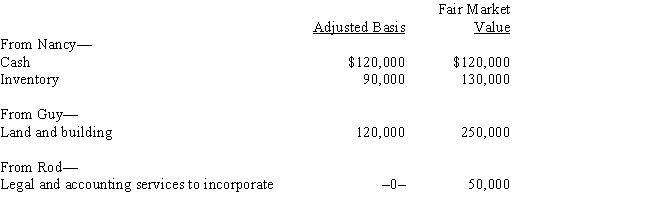

Nancy,Guy,and Rod form Goldfinch Corporation with the following consideration.

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy,200 to Guy,and 50 to Rod.In addition,Guy gets $50,000 in cash.

a.Does Nancy, Guy, or Rod recognize gain (or income)?

b.What basis does Guy have in the Goldfinch stock?

c.What basis does Goldfinch Corporation have in the inventory? In the land and building?

d.What basis does Rod have in the Goldfinch stock?

Definitions:

Graduate Internships

Professional work experiences offered to students who have completed or are currently enrolled in a graduate-level program, aimed at enhancing their skills and knowledge in a specific field.

Standard Error

A measure of the variability or dispersion of a sampling distribution, often used in the context of mean or proportion estimates.

Sampling Distribution

The probability distribution of a given random-sample-based statistic.

Variances

A measure of the dispersion or spread in a set of data points, indicating how much the values in a dataset differ from the mean.

Q2: Section 1250 depreciation recapture will apply when

Q27: Mitchell and Powell form Green Corporation.Mitchell transfers

Q44: During the current year,Goldfinch Corporation purchased 100%

Q46: What will cause the corporations involved in

Q78: During the current year,Quartz Corporation (a calendar

Q96: For purposes of the estimated tax payment

Q117: Section 1231 property generally does not include

Q131: When it liquidates,a partnership is not generally

Q154: Before allocations for the current year,Marvin's basis

Q161: Do noncorporate and corporate shareholders typically have