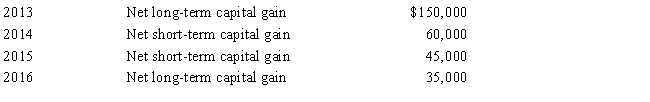

Carrot Corporation,a C corporation,has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2017.Carrot Corporation had taxable income from other sources of $720,000.Prior years' transactions included the following:

Compute the amount of Carrot's capital loss carryover to 2018.

Definitions:

Heart Disease

A broad term for a range of heart conditions that affect the heart’s structure and function, including coronary artery disease, arrhythmias, and congenital heart defects.

Low Water Intake

The consumption of insufficient amounts of water, potentially leading to dehydration and affecting bodily functions.

Muscle Strength

Refers to the ability of a muscle to exert force against resistance.

Body Mass Index

A measure of body fat based on height and weight that applies to adult men and women.

Q3: Generally,deductions for additions to reserves for estimated

Q51: On March 15,2015,Blue Corporation purchased 10% of

Q58: Which of the following events causes the

Q71: Carli contributes land to the newly formed

Q90: Personal use property casualty gains and losses

Q98: Purple Corporation makes a property distribution to

Q99: Arlene,who is single,reports taxable income for 2017

Q112: George and James are forming the GJ

Q112: Broker's commissions,legal fees,and points paid by the

Q121: Premiums paid on key employee life insurance