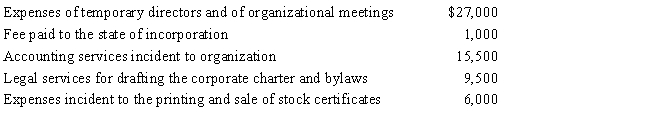

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2017.The following expenses were incurred during the first tax year (April 1 through December 31,2017) of operations.

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2017?

Definitions:

Taft-Hartley Act

A 1947 federal law in the United States that restricts the activities and power of labor unions.

National Labor Relations

Refers to the field of law and policy concerning how labor unions and employers interact in the United States, significantly shaped by the National Labor Relations Act (NLRA) of 1935.

Bilateral Monopoly

A market structure involving a single buyer and a single seller, leading to unique negotiation dynamics since both parties have significant market power.

Disruptive Strikes

Work stoppages initiated by employees to protest against their employers, with the aim of causing enough disruption to gain bargaining power.

Q6: Misty and John formed the MJ Partnership.Misty

Q7: Hannah,Greta,and Winston own the stock in Redpoll

Q10: Mogo Manufacturing Company accounts for its inventories

Q20: Rachel is the sole member of an

Q30: Lease cancellation payments received by a lessor

Q44: When depreciable property is transferred to a

Q48: Which of the following statements is correct

Q101: Corporate distributions are presumed to be paid

Q112: Williams owned an office building (but not

Q181: During the current year,Hawk Corporation sold equipment