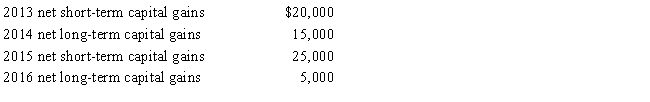

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2017.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

a.How are the capital gains and losses treated on Ostrich's 2017 tax return?

b.Determine the amount of the 2017 net capital loss that is carried back to each of the previous years.

c.Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d.If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2017 tax return?

Definitions:

Embraced Capitalism

The process of adopting capitalist economics and practices, characterized by private ownership, profit motive, and market competition.

Central Planning

An economic system where the government makes all decisions on the production and distribution of goods and services, aiming to control the economy.

Standard of Living

The degree of wealth and material comfort available to a person or community, measured by factors such as income, quality of housing, and access to services.

Rural Areas

Regions characterized by low population density and vast open spaces, often dominated by agricultural work and less developed infrastructure.

Q12: Nick exchanges property (basis of $100,000; fair

Q16: Short-term capital losses are netted against long-term

Q47: In corporate reorganizations,if an acquiring corporation is

Q49: Ryan has the following capital gains and

Q50: An individual had the following gains and

Q54: When is a redemption to pay death

Q115: Hazel,Emily,and Frank,unrelated individuals,own all of the stock

Q130: Larry was the holder of a patent

Q132: Katherine invested $80,000 this year to purchase

Q145: Wade is a salesman for a real