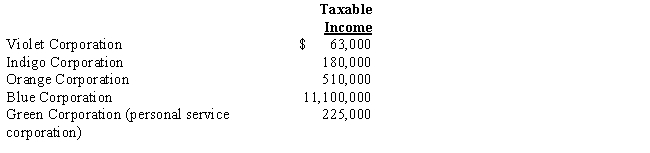

In each of the following independent situations,determine the corporation's income tax liability.Assume that all corporations use a calendar year 2017.

Definitions:

Restructuring Charges

Expenses associated with reorganizing a company, which may include layoffs, plant closures, or other major operational changes.

Continuing Operations

The segments or parts of a business expected to continue operating and contributing to earnings into the foreseeable future.

Layoffs

A reduction in a company's workforce to save costs or due to organizational restructuring.

Cash Flow

The collective sum of money that moves through a business, significantly contributing to its capacity to manage cash flow needs.

Q22: Depreciation recapture under § 1245 and §

Q46: What will cause the corporations involved in

Q48: The fair market value of property received

Q90: What is the rationale underlying the tax

Q105: Tungsten Corporation,a calendar year cash basis taxpayer,made

Q122: Ethel,Hannah,and Samuel,unrelated individuals,own the stock in Broadbill

Q128: What is the purpose of the AMT

Q133: A business taxpayer sold all the depreciable

Q159: For purposes of a partial liquidation,a distribution

Q191: Renee,the sole shareholder of Indigo Corporation,sold her