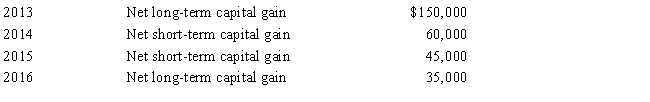

Carrot Corporation,a C corporation,has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2017.Carrot Corporation had taxable income from other sources of $720,000.Prior years' transactions included the following:

Compute the amount of Carrot's capital loss carryover to 2018.

Definitions:

Colluding Oligopoly

A market situation where a small number of firms agree to manipulate market conditions, such as price or output, for mutual benefit.

Industry Profit

The total earnings before tax and interest of firms within a particular industry, after all expenses have been deducted from revenues.

Identical Cost Structures

Situations in which businesses have the same fixed and variable costs in their production processes.

Profit-maximizing Output

The level of production at which a firm achieves the highest possible profit, determined by the point where marginal revenue equals marginal cost.

Q4: Factors that can cause the adjusted basis

Q7: To ease a liquidity problem,all of the

Q16: In the current year,Derek formed an equal

Q17: Red Corporation and Green Corporation are equal

Q36: A barn held more than one year

Q60: As a general rule,C corporations must use

Q84: In 2017,Linda incurs circulation expenses of $240,000

Q88: Hornbill Corporation,a cash basis and calendar year

Q102: An individual taxpayer received a valuable painting

Q151: Steve has a capital loss carryover in