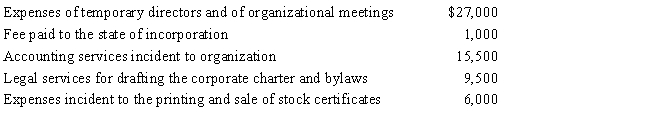

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2017.The following expenses were incurred during the first tax year (April 1 through December 31,2017) of operations.

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2017?

Definitions:

Marginal Utility

The extra utility or satisfaction derived from using or consuming one additional unit of a good or service beyond what was previously consumed.

Total Utility

The total satisfaction received from consuming a particular amount of goods or services.

Marginal Utility

The additional satisfaction or benefit a consumer derives from consuming one more unit of a good or service.

Additional Utility

The extra satisfaction or pleasure a person receives from consuming an additional unit of a good or service.

Q28: Virgil was leasing an apartment from Marple,Inc.Marple

Q35: Pursuant to a complete liquidation,Oriole Corporation distributes

Q48: Last year,Crow Corporation acquired land in a

Q49: Which of the following statements regarding a

Q57: What itemized deductions are allowed for both

Q57: The dividends received deduction has no impact

Q75: A business taxpayer sells inventory for $80,000.The

Q87: What are the tax consequences if an

Q93: Carryover

Q123: Vicki owns and operates a news agency