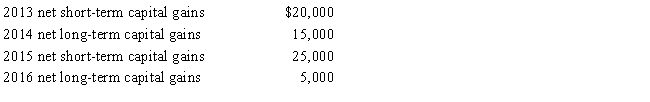

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2017.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

a.How are the capital gains and losses treated on Ostrich's 2017 tax return?

b.Determine the amount of the 2017 net capital loss that is carried back to each of the previous years.

c.Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d.If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2017 tax return?

Definitions:

Different Order

Arranging items or elements in a sequence that differs from the original or expected arrangement.

Colleagues

People with whom one works, especially in a professional or formal setting.

Email Frequently

This is not a proper key term. NO.

Work

Refers to physical or mental effort directed toward producing or accomplishing something, often in a job or professional context.

Q3: Schedule M-3 is similar to Schedule M-1

Q6: Which of the following comparisons is correct?<br>A)Corporations

Q27: Mitchell and Powell form Green Corporation.Mitchell transfers

Q60: An individual has the following recognized gains

Q63: Eagle Company,a partnership,had a short-term capital loss

Q69: Gold Corporation,Silver Corporation,and Platinum Corporation are equal

Q83: Which of the following must use the

Q105: The tax law requires that capital gains

Q117: A taxpayer who expenses circulation expenditures in

Q135: To compute the holding period,start counting on