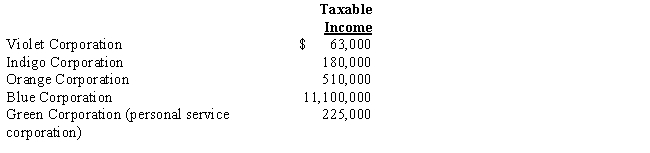

In each of the following independent situations,determine the corporation's income tax liability.Assume that all corporations use a calendar year 2017.

Definitions:

Selective Attachment Phase

A stage in the development of attachment where an infant shows a strong preference for certain familiar people over others, typically occurring around 7-9 months of age.

Initial-Preattachment Phase

The earliest stage in a child's attachment development, characterized by indiscriminate sociability and lack of distress when interacting with unfamiliar individuals.

Feeding Schedules

Planned intervals or times set for eating, used to maintain regularity in the consumption of food, especially important in dietary management for infants, pets, and certain medical conditions.

Negative Withdrawal

refers to the act or feeling of psychological or emotional detachment, often as a coping mechanism in response to stress or trauma.

Q20: At a time when Blackbird Corporation had

Q22: On December 31,2017,Flamingo,Inc.,a calendar year,accrual method C

Q27: The tax treatment of reorganizations almost parallels

Q32: In general,the basis of property to a

Q38: Cash dividends distributed to shareholders in 2017.

Q52: Because services are not considered property under

Q88: Explain the requirements for the termination of

Q105: Dawn is the sole shareholder of Thrush

Q115: Hazel,Emily,and Frank,unrelated individuals,own all of the stock

Q152: Rust Corporation distributes property to its sole