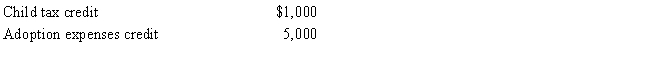

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000.and his tentative minimum tax is $195,000.Justin reports the following credits.

Calculate Justin's tax liability after credits.

Definitions:

Economic Profit

The profit from undertaking an activity after subtracting both the explicit and implicit costs associated with that activity.

Implicit Costs

Expenses that do not involve a direct monetary payment but represent the opportunity cost of using resources owned by the company or individual.

Average Cost of Production

The total cost of production divided by the quantity of output produced, indicating the cost to produce each unit of output.

Total Profit

The net profit a company earns, calculated by deducting all costs from its total income.

Q19: Contrast the tax treatment of capital gains

Q24: Terry,Inc.,makes gasoline storage tanks.All production is done

Q35: A realized gain on an indirect (conversion

Q51: Intangible drilling costs deducted currently.

Q58: In the case of an accrual basis

Q84: Finch Corporation distributes property (basis of $225,000,fair

Q107: The adjusted basis for a taxable bond

Q132: When a taxpayer has purchased several lots

Q157: Jared,a fiscal year taxpayer with a August

Q191: Casualty losses and condemnation losses on the