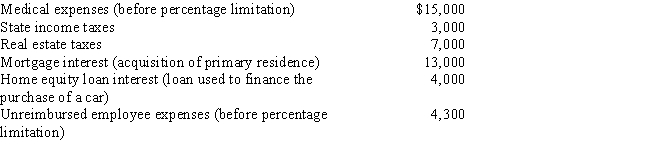

Mitch,who is single and age 46 and has no dependents,had AGI of $100,000 this year.His potential itemized deductions were as follows.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

Definitions:

External Audit

An external audit involves an independent examination of a company's financial statements and records carried out by an external (outside) auditor to ensure accuracy, fairness, and compliance with accounting standards and regulations.

Cloud-based

Refers to applications, services, or resources made available to users on demand via the internet from a cloud computing provider's servers.

Internet Performance Management

The practice of monitoring and controlling the performance of internet-related activities to ensure optimal operation.

Whaling Attacks

Sophisticated phishing schemes that target high-profile individuals within organizations, like executives, to gain access to sensitive data.

Q17: During the current year,Owl Corporation (a C

Q36: Starling Corporation was organized fifteen years ago

Q38: When a taxpayer transfers property subject to

Q68: Juan,not a dealer in real property,sold land

Q69: Grackle Corporation,a personal service corporation,had $230,000 of

Q74: The bank forecloses on Lisa's apartment complex.The

Q79: Eileen transfers property worth $200,000 (basis of

Q100: On February 1,Karin purchases real estate for

Q121: For regular income tax purposes,Yolanda,who is single,is

Q142: Which of the following creates potential §