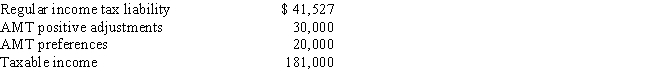

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2017.Robert itemizes deductions.

Calculate Robin's AMT for 2017.

Definitions:

Enjoyment

A feeling of pleasure and satisfaction obtained from various life activities or experiences.

Opportunity Cost

The financial implication of not selecting the following best possibility when faced with a decision.

Interest

The cost of borrowing money, typically expressed as a percentage of the amount borrowed, paid by borrowers to lenders.

Savings Account

A deposit account held at a bank or other financial institution providing principal security and a modest interest rate.

Q2: How can the positive AMT adjustment for

Q23: Ted,a cash basis taxpayer,received a $150,000 bonus

Q38: The accrual method generally is required for

Q46: Nonrefundable credits are those that reduce the

Q53: Interest income on private activity bonds issued

Q54: During the current year,Kingbird Corporation (a calendar

Q83: Which of the following must use the

Q98: Albert purchased a tract of land for

Q115: Stanley operates a restaurant as a sole

Q137: The Code contains two major depreciation recapture