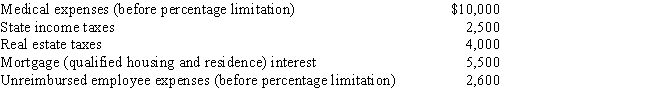

Cindy,who is single and age 48,has no dependents and has adjusted gross income of $50,000 in 2017.Her potential itemized deductions are as follows.

What are Cindy's AMT adjustments for itemized deductions for 2017?

Definitions:

Endocrine System

The system of glands that release hormones into the bloodstream to regulate the body's growth, metabolism, and sexual development and function.

Electrical Impulses

Rapid signals that travel along neurons, essential for the transmission of information throughout the nervous system.

Chemical Messengers

substances, such as hormones or neurotransmitters, that are released by cells to communicate with other cells, affecting various bodily functions.

Adaptability

The ability of an organism to adjust to changes in its environment or to new situations.

Q5: Briefly describe the accounting methods available for

Q40: Jen,the sole shareholder of Mahogany Corporation,sold her

Q48: A retailer must actually receive a claim

Q64: Gold Corporation sold its 40% of the

Q78: In regard to choosing a tax year

Q112: At the beginning of the current year,Paul

Q168: Charitable contribution carryforward deducted in the current

Q184: Ross lives in a house he received

Q208: Under what circumstances will a distribution by

Q275: If there is an involuntary conversion (i.e.,casualty,theft,or