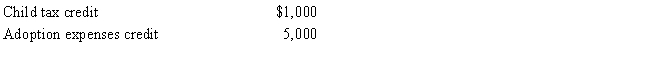

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000.and his tentative minimum tax is $195,000.Justin reports the following credits.

Calculate Justin's tax liability after credits.

Definitions:

Trade Deficit

A situation where a country's imports exceed its exports, leading to more money leaving the country than entering it.

Interest Rates

The cost of borrowing money or the return on investment for savings and loans, expressed as a percentage.

Government Outlays

The total expenditures made by the government, including spending on goods and services, transfer payments, and interest on debt.

Government Revenues

The income received by the government from taxes and non-tax sources used to fund public services and expenditures.

Q23: Are the AMT rates for the individual

Q44: What is the general formula for calculating

Q49: Discuss the treatment of realized gains from

Q67: Beth forms Lark Corporation with a transfer

Q69: Gold Corporation,Silver Corporation,and Platinum Corporation are equal

Q98: Copper Corporation owns stock in Bronze Corporation

Q148: Kelly,who is single,sells her principal residence,which she

Q212: Gains and losses on nontaxable exchanges are

Q250: If a taxpayer purchases taxable bonds at

Q264: Marilyn owns 100% of the stock of