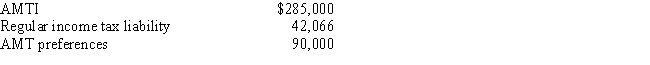

Caroline and Clint are married,have no dependents,and file a joint return in 2017.Use the following information to calculate their Federal income tax liability.

Definitions:

Negotiator Power

The ability of a negotiator to influence the behavior or decision-making of another party in a negotiation.

Verbal Slips

Verbal slips are unintended mistakes in speech, often revealing subconscious thoughts or feelings, or occurring due to a lapse in linguistic processing.

Strengthen Commitment

The act of reinforcing one's dedication or promise towards a goal or decision.

Ultimate Weapon

A tool, weapon, or strategy considered to be the most effective or powerful in achieving victory or overcoming challenges.

Q6: In 2007,a medical doctor who incorporated his

Q13: Nell records a personal casualty loss deduction

Q17: Vertigo,Inc.,has a 2017 net § 1231 loss

Q18: The company has consistently used the LIFO

Q43: An employer's tax deduction for wages is

Q59: The transfer of an installment obligation in

Q80: Fran was transferred from Phoenix to Atlanta.She

Q178: Paula inherits a home on July 1,2017

Q231: Under what circumstances may a partial §

Q256: Liz,age 55,sells her principal residence for $600,000.She