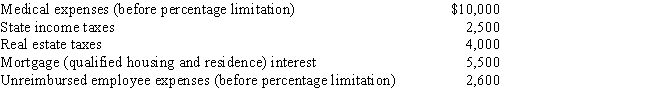

Cindy,who is single and age 48,has no dependents and has adjusted gross income of $50,000 in 2017.Her potential itemized deductions are as follows.

What are Cindy's AMT adjustments for itemized deductions for 2017?

Definitions:

Withdrawals

Funds drawn from the enterprise by its proprietors for their personal needs.

Revenues

Revenues are the total income generated by a company from its business activities, such as sales of goods or services, before any expenses are deducted.

Expenses

The costs incurred in the process of earning revenue, including operating costs, taxes, interest, and cost of goods sold.

Cash Investments

Funds placed into financial instruments or assets with the expectation of preserving capital and generating a return.

Q4: The control requirement under § 351 requires

Q9: The DEF Partnership had three equal partners

Q15: The § 1245 depreciation recapture potential does

Q39: Peach Corporation had $210,000 of net active

Q46: A taxpayer may never recognize a loss

Q74: The bank forecloses on Lisa's apartment complex.The

Q79: Eileen transfers property worth $200,000 (basis of

Q95: In 2013,Harold purchased a classic car that

Q122: If the AMT base is greater than

Q132: When a taxpayer has purchased several lots