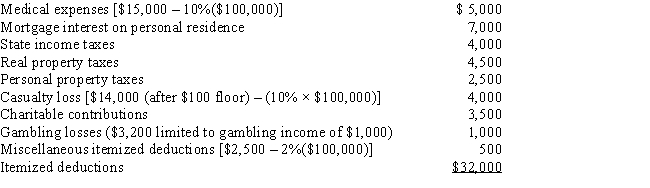

Darin,who is age 30,records itemized deductions in calculating 2017 taxable income as follows.

a.Calculate Darin's itemized deductions for AMT purposes using the direct method.

b.Calculate Darin's itemized deductions for AMT purposes using the indirect method.

Definitions:

Department

A distinct part of an organization with a specific function or group of related functions.

Process Costing

An accounting methodology used for distributing costs to each unit of output in continuous production processes.

Journal Entries

The basic method of recording financial transactions in accounting, ensuring every transaction reflects both a debit and a credit.

Transactions

Financial activities or events that affect the financial position of a company, involving the exchange or transfer of goods, services, or funds.

Q7: Section 1231 lookback losses may convert some

Q16: Short-term capital losses are netted against long-term

Q17: In order to encourage the development of

Q35: To carry out a qualifying stock redemption,Turaco

Q43: Do AMT adjustments and AMT preferences increase

Q58: Evelyn's office building is destroyed by fire

Q58: Copper Corporation,a C corporation,had gross receipts of

Q71: Theresa and Oliver,married filing jointly,and both over

Q109: The required adjustment for AMT purposes for

Q223: The basis of boot received in a