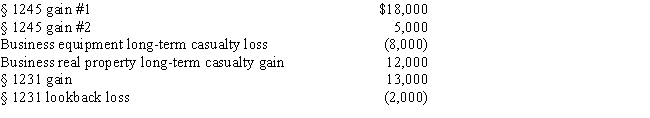

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Liability Insurance Policy

A financial product that provides the insured party with protection against claims resulting from injuries and damage to people and/or property.

Prepaid Expense

Expenses paid in advance for goods or services to be received in the future, recorded as assets on the balance sheet until they are actually consumed.

Insurance Expense

The cost recognized in the accounting period related to the premiums paid for insurance policies.

Retained Earnings

Profits that a company keeps after dividends are paid to shareholders, used for reinvestment in the business or to pay off debt.

Q13: Nell records a personal casualty loss deduction

Q47: Use the following data to calculate Jolene's

Q61: What is the purpose of Schedule M-3?

Q67: Kerri,who has AGI of $120,000,itemized her deductions

Q83: Which,if any,of the following exchanges qualifies for

Q84: In the current year,Plum Corporation,a computer manufacturer,donated

Q85: Sand Corporation,a calendar year C corporation,reports alternative

Q106: An employee with outside income may be

Q177: Faith inherits an undivided interest in a

Q266: Discuss the logic for mandatory deferral of