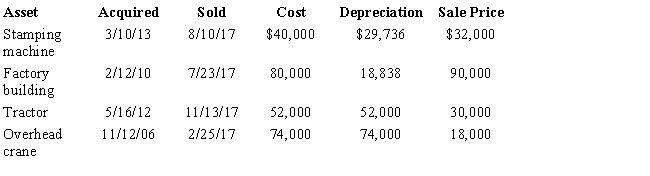

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Definitions:

Combinations

The selection of items from a larger set where order does not matter.

Distribution

The way in which values in a dataset are spread or dispersed across the range of data points.

Kurtosis

The quality of a distribution that defines how flat or peaked it is.

Positively Skewed

A description of a distribution that has a tail extending to the right, indicating a concentration of values on the lower end.

Q5: Using your knowledge of GAAP and financial

Q31: In computing the foreign tax credit,the greater

Q33: The amount realized does not include any

Q42: Harry and Wilma are married and file

Q55: Robert sold his ranch which was his

Q72: Shari exchanges an office building in New

Q78: In regard to choosing a tax year

Q82: Lucy owns and actively participates in the

Q94: In 2016,Jenny had a $12,000 net short-term

Q109: Depreciable personal property was sold at a