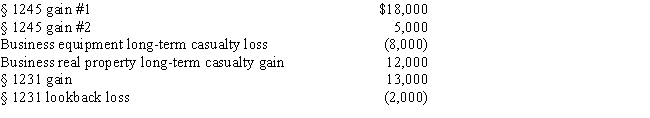

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Marginal Rate Of Technical Substitution

The rate at which one input can be reduced per additional unit of another input, while maintaining the same level of output.

Efficiency

The optimal use of resources to achieve the desired ends, minimizing waste and maximizing output.

General Equilibrium Prices

The set of prices for all goods and services in an economy at which supply and demand across all markets are in balance.

Recreational Activities

Activities undertaken for pleasure, leisure, and relaxation during free time.

Q9: Wallace owns a construction company that builds

Q15: The § 1245 depreciation recapture potential does

Q20: On October 2,Ross quits his job with

Q74: The bank forecloses on Lisa's apartment complex.The

Q77: Which of the following statements is incorrect

Q90: Todd,a CPA,sold land for $300,000 cash on

Q108: The tax law requires that capital gains

Q112: Explain the rules regarding the accounting periods

Q125: Prior to consideration of tax credits,Clarence's regular

Q233: Weston sells his residence to Joanne on