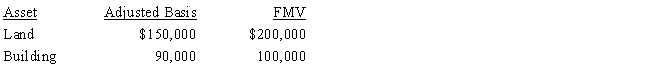

On September 18,2017,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2014,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000. Determine Jerry's adjusted basis and holding period for the land and building.

Definitions:

Voir Dire

A process in court where jurors are questioned by judges and lawyers to determine if they are suitable for jury service.

Arbitration

A method of dispute resolution outside of courts where an arbitrator makes a decision which is binding to both parties.

Litigation

The process of resolving disputes or controversies by filing lawsuits in court.

Mediation

A form of alternative dispute resolution where a neutral third party helps the disputing parties come to a mutually agreeable solution.

Q13: Under the taxpayer-use test for a §

Q22: If a seller assumes the buyer's liability

Q22: Taylor sold a capital asset on the

Q26: Beulah,who is single,provides you with the following

Q35: The AMT adjustment for mining exploration and

Q43: Rick,a computer consultant,owns a separate business (not

Q44: On December 31,2017,Lynette used her credit card

Q65: The maximum § 1245 depreciation recapture generally

Q88: Casualty gains and losses from nonpersonal use

Q132: A retail building used in the business