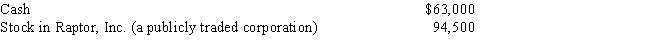

During the current year,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is Ralph's charitable contribution deduction for the current year?

Definitions:

FIFO Method

"First In, First Out," an inventory valuation method assuming goods first purchased or produced are the first to be sold.

Perpetual Inventory System

An inventory system that tracks merchandise in real-time, updating inventory records immediately upon purchase or sale.

Periodic Inventory System

An inventory accounting system where updates to inventory levels and Cost of Goods Sold are made at set intervals.

GAAP

Generally Accepted Accounting Principles, which are a common set of accounting principles, standards, and procedures that companies must follow when they compile their financial statements.

Q13: A taxpayer may elect to use the

Q45: Jermaine and Kesha are married,file a joint

Q70: Roger is considering making a $6,000 investment

Q79: For all of the current year,Randy (a

Q82: Ethan,a bachelor with no immediate family,uses the

Q101: Which of the following is not a

Q101: Qualified research and experimentation expenditures are not

Q101: Shirley pays FICA (employer's share) on the

Q104: Maria made significant charitable contributions of capital

Q124: Dennis,a calendar year taxpayer,owns a warehouse (adjusted