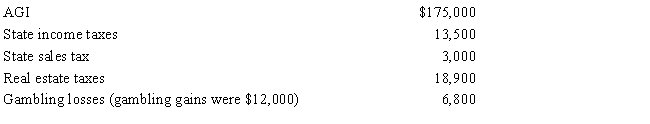

Paul,a calendar year married taxpayer,files a joint return for 2017.Information for 2017 includes the following:

Paul's allowable itemized deductions for 2017 are:

Definitions:

Foot Care

The routine maintenance and treatment of the feet, important for preventing and managing conditions like diabetes-related neuropathy.

Osteoarthritis

A type of arthritis that occurs when flexible tissue at the ends of bones wears down.

Home Care Visit

A visit by healthcare professionals to a patient's home to provide medical services and support.

Daily Activities

The routine tasks and engagements that an individual participates in on a day-to-day basis.

Q40: Under the alternative depreciation system (ADS),the half-year

Q60: Raul is married and files a joint

Q61: Arnold and Beth file a joint return.Use

Q64: Augie purchased one new asset during the

Q77: Nancy paid the following taxes during the

Q77: All domestic bribes (i.e.,to a U.S.official) are

Q80: Fran was transferred from Phoenix to Atlanta.She

Q85: Bradley has two college-age children,Clint,a freshman at

Q109: Cheryl is single,has one child (age 6),and

Q239: If a taxpayer purchases a business and