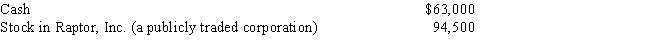

During the current year,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is Ralph's charitable contribution deduction for the current year?

Definitions:

Issues Management

The process of identifying, analyzing, and responding to issues that could potentially impact an organization's performance, reputation, or operational effectiveness.

Social and Political Change

Transformations in the structure or policies of a society or political system, often driven by collective movement or governmental reform.

Managing Diversity Programs

The coordination of activities and strategies to encourage diversity and inclusion within an organization's culture.

Organizational Flexibility

The ability of a company to adapt quickly to market changes or internal innovations, allowing for responsive and effective operations.

Q3: Gray Company,a closely held C corporation,incurs a

Q11: Jacob is a landscape architect who works

Q16: Sue has unreimbursed expenses.

Q37: Payments by a cash basis taxpayer of

Q42: On July 10,2017,Ariff places in service a

Q55: During the past two years,through extensive advertising

Q85: For a new car that is used

Q110: Discuss the 2%-of-AGI floor and the 50%

Q124: Jackson gives his supervisor and her husband

Q141: Deductions are allowed unless a specific provision