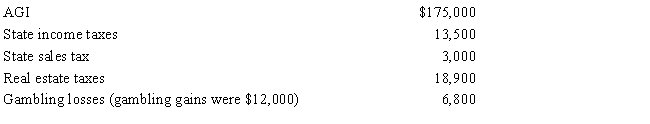

Paul,a calendar year married taxpayer,files a joint return for 2017.Information for 2017 includes the following:

Paul's allowable itemized deductions for 2017 are:

Definitions:

Overly Optimistic

The tendency to hold an excessively positive outlook on one's abilities, outcomes, or future events.

Zeigarnik Effect

The psychological phenomenon whereby individuals remember uncompleted or interrupted tasks better than completed ones.

Achievement

The accomplishment of an aim or purpose, often recognized because of effort or skill.

Goals

Goals or intended results that a person or a team strives to accomplish.

Q6: During the year,Sophie went from Omaha to

Q15: Discuss the difference between the half-year convention

Q51: Sue charges by the hour for her

Q53: In 2018,Rhonda received an insurance reimbursement for

Q64: Purple Corporation,a personal service corporation,earns active income

Q68: What effect do the assumption of liabilities

Q69: Which of the following best describes the

Q70: Byron,who lived in New Hampshire,acquired a personal

Q97: An employer calculates the amount of income

Q133: Qualified moving expenses of an employee that