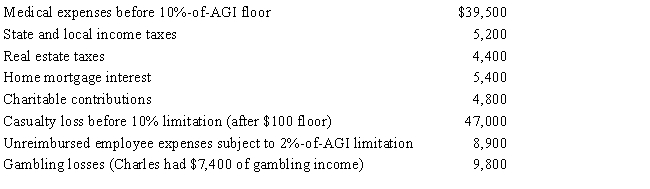

Charles,who is single and age 61,had AGI of $400,000 during 2017.He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Unilateral Threat

This term describes a situation where one party threatens to take action independent of others' preferences or actions.

Conflict Resolution

The process of resolving a dispute or disagreement between two or more parties in a constructive manner.

Communication

The exchange of information, ideas, thoughts, and feelings between two or more entities, through various modes such as voice, writing, or behavior.

Cohesive

Characterizes a group that is united and works well together, showing a high level of camaraderie and shared goals.

Q11: Which of the following is not deductible?<br>A)Moving

Q24: Identify two tax planning techniques that can

Q33: During 2017,Kathy,who is self-employed,paid $650 per month

Q48: Realizing that providing for a comfortable retirement

Q54: Maria traveled to Rochester,Minnesota,with her son,who had

Q71: Aaron is a self-employed practical nurse who

Q85: Nell sells a passive activity with an

Q221: Use the following data to determine the

Q233: Weston sells his residence to Joanne on

Q250: If a taxpayer purchases taxable bonds at