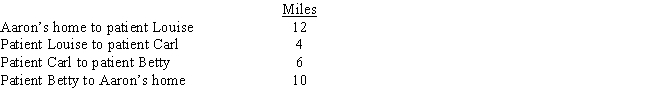

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.

Aaron's deductible mileage for each workday is:

Definitions:

Kinsey's Model

A scale developed by Alfred Kinsey to describe a person's sexual orientation based on their experiences or responses at a given time.

Sexual Orientation

A person's pattern of emotional, romantic, or sexual attraction to others, based on the gender(s) to which one is attracted.

Cohabitation

Living together in a romantic relationship without being married.

Domestic Partnership

A legal recognition of a couple's relationship, granting them certain rights, protections, and benefits similar to those of marriage.

Q3: Phyllis,a calendar year cash basis taxpayer who

Q24: Contributions to public charities in excess of

Q30: Which of the following is incorrect?<br>A)The deferral

Q33: Any § 179 expense amount that is

Q34: Kevin and Sue have two children,ages 8

Q43: Nondeductible moving expense

Q61: Arnold and Beth file a joint return.Use

Q67: Samuel,a 36 year old individual who has

Q72: In the current year,Lucile,who has AGI of

Q97: An employer calculates the amount of income